Dental Insurance Las Vegas, NV

Dental insurance is a form of health insurance designed to cover some of the costs of standard dental care. Fortunately, compared to health insurance, dental insurance is relatively easy to understand. Dental insurance is also available either as a standalone policy or part of a larger medical insurance plan.

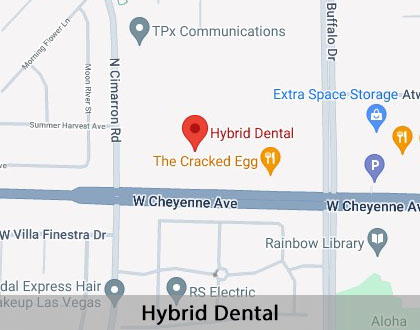

If you are looking for a new dental insurance plan, make sure you know the different options before making your final decision. No matter what choice you make, we at Hybrid Dental are here for you. We are proud to serve patients in Las Vegas and the surrounding area. Call us today at (702) 658-8008 to schedule an appointment or learn more about our services.

Understanding Dental Insurance

Dental insurance gives people coverage to help pay for certain types of dental work. Having this coverage is the best way to prepare for any unexpected dental problems that might arise. Each month, people will pay a set dollar amount, called a premium, to pay for coverage. The monthly premium will depend on the insurance company, the location, and the chosen plan. Depending on the insurance plan, it can cover some or even all of the costs of certain dental treatments.

In many cases, the dentist's office will bill the insurance plan directly for care provided, and the patient will only need to pay a copay for each visit or treatment. A dentist can not answer questions about a specific dental insurance plan or predict what level of coverage for a particular procedure will be. People should contact their employer's benefits department, dental insurance plan, or the third-party payer of a health plan for any questions about coverage.

“Depending on the insurance plan, it can cover some or even all of the costs of certain dental treatments.”

Choosing the Right Dental Plan for You

Choosing the right dental plan can be an intimidating process. There are many different types of dental plans. For instance, group insurance, individual and family plans, indemnity dental plans, preferred provider organization (PPO) plans, and health maintenance organization (HMO) plans are all possible choices.

Indemnity dental plans are also known as "fee-for-service plans." They are not as common in the Marketplace, and insurers cap the amount of money they will pay for certain procedures in this type of plan. Patients will have to pay out-of-pocket if a dentist charges higher than this set amount. A preferred provider organization (PPO) plan is much more common. Patients who choose to use out-of-network providers with a PPO plan will have to pay more out of pocket. With a health maintenance organization (HMO) plan, patients must pay monthly or annual premiums but can only see providers within their network.

“Choosing the right dental plan can be an intimidating process.”

Coverage Under Dental Plans

It is important to know what each type of dental insurance plan covers and does not cover. If an issue does arise, dental insurance will usually help cover a portion of the treatment cost, so people do not have to pay the full bill by themselves. Carefully review each potential insurance policy to budget for expected and possible emergency dental expenses.

Preventative dental care is usually 100% covered since it catches signs and symptoms of dental disease early and reduces the chance that a patient will need more complex treatment later. This will cover routine preventive and diagnostic care, such as cleanings and exams. Most plans have limits of coverage. Not all dental plans include coverage for orthodontic services, so people should carefully read the details of their plan. If unsure whether dental insurance covers preventative dental care or orthodontic services, people should call their provider to learn more about the plan details.

“If unsure whether dental insurance covers preventative dental care or orthodontic services, people should call their provider to learn more about the plan details.”

Check out what others are saying about our dental services on Yelp: Dental Insurance in Las Vegas, NV

Affordable Care Act (ACA) Online Enrollment

Dental coverage is available through the Marketplace in two ways: as part of a health plan or on its own as a separate, standalone plan. However, it is essential to note that patients cannot buy a Marketplace dental plan without purchasing a health plan at the same time. Additionally, not every Marketplace health plan includes dental coverage. Purchasing an individual dental plan also necessitates paying another additional premium. While dental coverage is not considered an essential health benefit for adults, it is regarded as an essential health benefit for children.

Marketplace dental plans are split into two categories: high and low. High coverage level plans have lower copays and deductibles but higher premiums. Accordingly, low coverage level plans have higher copayments and deductibles but lower premiums. Comparing dental plans in the Marketplace gives the most details about each plan's copayments, costs, deductibles, and services covered.

“Dental coverage is available through the Marketplace in two ways: as part of a health plan or on its own as a separate, standalone plan.”

Questions Answered on This Page

Q. How does dental insurance work?

Q. How can someone find out what procedures their dental insurance covers?

Q. How can I find out if my employer's plan covers dental treatments?

Q. What are the different kinds of dental plans?

Q. Is dental coverage available through the ACA Marketplace?

People Also Ask

Q. Is dental insurance worth it?

Q. How should people spend and invest their HSA contributions?

Q. What should patients do if they have sensitive teeth?

Dental Insurance Through Employers

Most dental insurance plans follow the 100-80-50 coverage structure. That means the plan covers preventative care at 100%, basic procedures at 80%, and major procedures at 50%. Sometimes major procedures have a larger copayment. Some dental plans do not cover some procedures, so people must check with their insurance provider for more information.

Employer-sponsored health insurance is the primary source of coverage for people in the United States. People should carefully read the details of an employer's dental insurance plan to determine whether the care they require is covered and at what percentage. Call the insurance provider directly with any questions or concerns.

“If your employer provides dental insurance, carefully read the details of your plan to determine if the care you require comes covered by the plan, and at what percentage.”

Dental Insurance Fees

Like health insurance plans in the United States, dental insurance plans come with costs, such as deductibles and copays. A deductible is a minimum amount that a person must pay before the insurance policy pays for anything. The deductible will vary depending on the type of dental insurance. Once the patient pays the deductible, their insurance plan will pay for the remaining costs.

Patients may also have to pay a preset amount, called a co-pay, before receiving a service or treatment covered by your insurance provider. The co-pay is usually due to the dentist at the time of the service. People will have to pay it even after they reach their deductible.

“Similar to health insurance plans in the United States, dental insurance plans come with costs.”

Frequently Asked Questions

Q. Is dental health really that important?

A. Yes. Many people mistakenly underestimate the importance of oral health. However, it is intrinsically linked to overall health. Neglecting one's oral health may have disastrous effects overall.

Q. Do I actually need a dental insurance plan?

A. Yes. Dental healthcare can be costly without insurance, especially if you are keeping up with your routine checkups and cleanings. Choosing the right dental insurance plan can help patients afford preventative dental care.

Q. What questions should I ask while looking for the right dental insurance plan for me?

A. There are a few things to keep in mind when looking for dental insurance plans. For example, if you anticipate needing a procedure in the future, make sure to ask whether it will be covered under your insurance. You should also ask if you can see any dentist of your choosing or if you must select one within the provider network, whether you can change dentists once you are enrolled, and how many people the plan will cover. Other pertinent information includes the deductible and copay costs and whether the plan is rated highly by an independent rating firm.

Q. What is a discount dental plan (DDP)?

A. A discount dental plan (DDP) is an untraditional insurance plan where the patient pays the cost of treatment at the contracted rate as determined by the plan. This type of plan does not involve any claim forms. However, patients must make monthly or annual payments to receive care from providers within the dental network at discounted prices and on a set fee schedule.

Q. Who should I talk to about my dental insurance plan's benefits or a claim?

A. Contact your insurance carrier for any questions and concerns you may have about your benefits or claims. They can access your account to review your benefits, claims activity, and eligibility.

Dental Terminology

Call Us Today

Dental insurance can help you offset the cost of dental care. Hybrid Dental can help you learn more about what your plan covers. Call us today at 702-658-8008 to learn more about our services or schedule an appointment.

Helpful Related Links

- American Dental Association (ADA). Glossary of Dental Clinical Terms. 2024

- American Academy of Cosmetic Dentistry® (AACD). Home Page. 2024

- WebMD. WebMD’s Oral Care Guide. 2024

About our business and website security

- Hybrid Dental was established in 2012.

- We accept the following payment methods: American Express, Cash, Check, Discover, MasterCard, and Visa

- We serve patients from the following counties: Clark County and Nye County

- We serve patients from the following cities: Las Vegas, Summerlin, North Las Vegas, Spring Valley, Paradise, Henderson, Centennial Hills, Mt Charleston, Enterprise and Pahrump

- National Provider Identifier Database (1306143847). View NPI Registry Information

- Healthgrades. View Background Information and Reviews

- Norton Safe Web. View Details

- Trend Micro Site Safety Center. View Details

Back to top of Dental Insurance