When to Spend Your HSA Las Vegas, NV

A health savings account (HSA) is a tax-advantaged savings account that people can use for qualified medical expenses. People with high-deductible health plans can benefit from having an HSA to pay for out-of-pocket medical expenses. This account can help people save money on medical and dental costs.

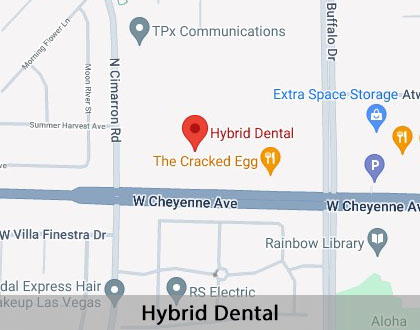

Using an HSA is a great option to pay for dental treatment. People can use their HSA to help pay for dental services at Hybrid Dental in Las Vegas and the surrounding area. Call us at (702) 658-8008 to learn more or to schedule an appointment.

An Investment Tool for Retirement

As Healthcare.gov explains, an HSA is a tax-free account people use to help cover some medical costs. To contribute to an HSA, patients must have a high-deductible insurance plan. There is a yearly limit to the amount of money contributed to an HSA plan.

Unlike flexible savings accounts, the funds in an HSA roll over each year. This allows the balance to continue to grow. Once individuals reach retirement age, they can use their HSA funds for anything, not just medical expenses. An HSA is a great investment tool for retirement since other types of retirement accounts incur taxes.

“An HSA is a great investment tool for retirement since other types of retirement accounts incur taxes.”

HSA Tax Benefits

HSA's offer a triple-tax advantage through pre-tax contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses. People that use their HSA to pay for qualified dental expenses do not have to pay federal taxes. Contributions made to the account can occur through the owner's funds or payroll deductions from work. Payroll deductions are tax-deductible, while savings from personal funds are not subject to FICA taxes.

People who choose to use an HSA can benefit from growing their account balance free of taxes. The interest, dividends, and capital gains that people earn from their accounts are tax-free. This tax-free advantage differs from other retirement accounts, such as a 401(k), which requires people to pay income taxes when withdrawing funds. The more a person adds to their HSA fund, the more tax-free earnings they can receive.

“HSA’s offer a triple-tax advantage through pre-tax contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses.”

Investing and Spending Strategies

The key to taking advantage of the HSA rules is to spend and invest wisely. Since there are many benefits to keeping an HSA for retirement expenses, it is important for people not to spend all their contributions. Instead, opt to spend a little on routine out-of-pocket medical or dental expenses and keep the balance growing with contributions.

Many dental expenses qualify for HSA spending. For items that are not covered by insurance, the HSA can help bridge the gap. To grow an HSA balance, it is a good idea to invest a portion of it in mutual funds, bonds, or stocks.

“To grow an HSA balance, it is a good idea to invest a portion of it in mutual funds, bonds, or stocks.”

Check out what others are saying about our dental services on Yelp: When to Spend Your HSA in Las Vegas, NV

Transferring an HSA When Changing Jobs

Another benefit of having an HSA is the ownership of it. The person who opened the HSA account is the owner, not their employer. People that move jobs and change health plans do not have to worry about losing their HSA.

Once people move to a new job and receive a new plan, they can roll their previous account into their new one. HSA balances also roll over, so there is no risk of losing any money left over in the account at the end of the year. HSA users will have access to their money for qualified expenses.

“People that move jobs and change health plans do not have to worry about losing their HSA.”

Questions Answered on This Page

Q. Why is an HSA a good investment tool for retirement?

Q. How should people spend and invest their HSA contributions?

Q. When is the right time to open an HSA?

Q. What are the HSA tax benefits?

Q. What are the steps in transferring an HSA when changing jobs?

People Also Ask

Q. What services are offered by a general dentist?

Q. What are some of the pros and cons of an HSA?

Q. What are the different kinds of dental plans?

Q. Do FSAs cover dental treatments?

Q. What is the difference between a dental cleaning and a deep cleaning?

The Right Time To Open an HSA

There are different strategies for the timing of opening a new HSA. If a person is qualified, they can open an HSA account at any time. We recommend that people open an HSA at the beginning of their careers when they are young and healthy and do not have many medical expenses.

Young people may also benefit from a high-deductible plan and get the most out of the potential long-term retirement savings. People interested in opening an HSA should develop an investment and savings strategy. Then they should research the different options for opening and setting up an HSA.

“The rules of transferring an HSA are dependent on the employer-sponsored health insurance plan.”

Frequently Asked Questions

Q. What are some examples of qualified medical expenses for a healthcare savings account?

A. HSA withdrawals are only tax-free when spent on qualifying medical expenses. These include out-of-pocket expenses for doctor visits, medical procedures, co-pays, dental costs, vision care, medications, and feminine hygiene products. The expenses can be for the individual, a spouse, or a dependent.

Q. How much can I contribute each year to my HSA?

A. Each year, the IRS sets a limit on the amount of money someone can contribute to an HSA. For 2021, the limit for an individual is $3,600, and for a family, it is $7,200. Individuals over the age of 55 can contribute an additional $1,000 each year as a catch-up contribution.

Q. What is a high-deductible health insurance plan?

A. To qualify for an HSA, an individual must be participating in a high-deductible health plan. With these, the individual is responsible for paying a certain amount before the health insurance company steps in and starts covering expenses. The deductible needs to be at least $1,400 for an individual plan or $2,800 for a family plan.

Q. What are the penalties for withdrawing funds for ineligible purchases for an HSA?

A. There is a penalty when using an HSA to pay for things that are not qualifying medical expenses. First, you have to pay taxes on that money as it now counts as income. Next, if you are younger than 65, you are charged another 20% penalty on the funds. To avoid this, do not withdraw HSA funds for non-medical expenses.

Q. Who else can contribute to my HSA?

A. Some employers also make contributions to their staff's HSA plans. If your job contributes to your HSA, be sure that you do not go over the IRS contribution limit. Excess contributions will result in a 6% tax penalty.

Dental Terminology

Call Us Today

There are many advantages to HSA, from managing the costs of some dental treatments to investing for retirement. Our team can help you understand how these savings accounts work and what expenses qualify. Call us at 702-658-8008 for more information or to schedule an appointment.

Helpful Related Links

- American Dental Association (ADA). Glossary of Dental Clinical Terms. 2024

- American Academy of Cosmetic Dentistry® (AACD). Home Page. 2024

- WebMD. WebMD’s Oral Care Guide. 2024

About our business and website security

- Hybrid Dental was established in 2012.

- We accept the following payment methods: American Express, Cash, Check, Discover, MasterCard, and Visa

- We serve patients from the following counties: Clark County and Nye County

- We serve patients from the following cities: Las Vegas, Summerlin, North Las Vegas, Spring Valley, Paradise, Henderson, Centennial Hills, Mt Charleston, Enterprise and Pahrump

- National Provider Identifier Database (1306143847). View NPI Registry Information

- Healthgrades. View Background Information and Reviews

- Norton Safe Web. View Details

- Trend Micro Site Safety Center. View Details

Back to top of When to Spend Your HSA